/03/24 · A positive correlation is a relationship between two currency pairs in which both pairs move in tandem. We can see the positive correlation between the demand for the product and its price, the price increases when the demand for the product increases. Similarly, in the forex market, currency pairs of positive correlation, both pairs go in blogger.comted Reading Time: 7 mins /07/14 · Forex correlation represents the positive or negative relationship between two separate currency pairs. Positive correlation % means that two pairs increase or Estimated Reading Time: 7 mins /06/11 · The pairing enjoys high volatility due to the inverse relationship between the Australian dollar and Japanese yen. Currency pairs differ in terms of volatility levels and traders can decide to trade high volatile pairs or pairs with lower volatility. The volatility of a currency pair shows price movements during a specific blogger.comted Reading Time: 9 mins

Currency Pair Correlations - Forex Trading | OctaFX

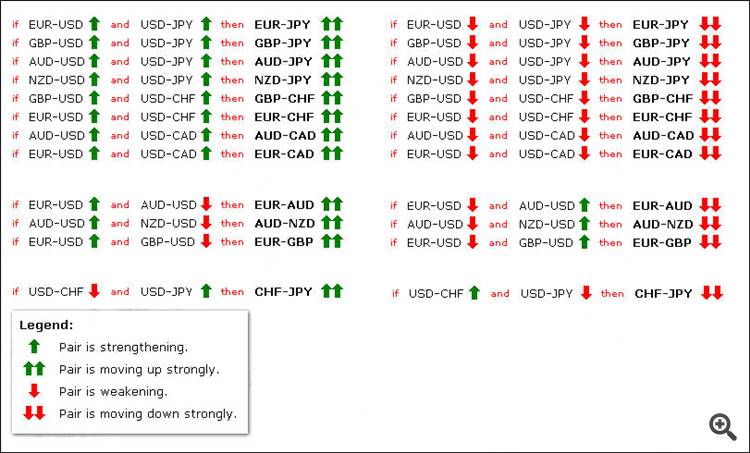

Looking for currency pairs that correlate is a great way to boost your awareness of the markets and how you can take advantage of understanding this simple process. All whilst improving your outlook on forex trading. A Correlation of currency within the forex consist of a positive or negative type of relationship between two different pairs of currency. A Positive correlation indicates that two pairs of currency proceed in tandem, forex relationship between pairs.

A Negative correlation indicates that the two forex pairs will move in opposite directions. Correlations offer chances to grasp a bigger profit, so it can be utilised to hedge the positions of your forex and forex relationship between pairs to risk. If you are sure that one pair of currency will proceed alongside or in opposition to another, then you could either unlock another position to boost your profits.

You can unlock another forex relationship between pairs for hedging your present exposure if volatility maximizes in the market. It can also cause your hedging to be less effective than you anticipated. Here is an example of a correlated move forex relationship between pairs the EURUSD and GBPUSD on a 5-minute chart: Source: tradingview. com As you can see the blue and green lines which is the close prices are moving almost in sync, which is expected from this forex pair. Source: tradingview.

com Here you can see a clear inverse in correlation as the blue and green lines move away from each other almost instantly. Which forex pairs are most correlated? This question is often asked by a lot of people. Well, the highly correlated currency pairs usually consist of economic ties that are very close.

It also includes their geographic proximity or distance, and their rank as the two of the globally-held and most sought out reserve currencies. The forex pairs correlation table shows the examples of correlations among currencies that are highly traded in the world.

The forex currency pair correlation table shows the correlations that were calculated over a period of one month, forex relationship between pairs. It was done utilizing the Pearson correlation coefficient. If not rendered properly, please turn your mobile device screen landscape sideways to view table easily. As you already know about the forex majors and minoryou will forex relationship between pairs that the USD is paired with the majority of the currency pairs.

As you know by now, currency pairs move in a correlated way, however, it is possible for them to have a perfect negative correlation. When a currency pair move is a perfect negative correlation, this is represented with a 0. This means whenever a currency pair moves upwards, the perfect negative correlation currency pair moves downwards — pip for pip. What this means is traders are buying the USD as they believe in the prospects of the US economic future vs.

the Euro. So in practice, they are selling the EUR to buy the USD — thus triggering the downward move. In this case, forex traders are buying the USD and selling the CAD. Now, why the USD? Because it forex relationship between pairs the currency reserve. So anything affecting the USD will have a larger effect on all USD forex pair crosses. You should be aware and alert of the fact that currency correlations are changing continuously over time.

The reason behind these changes is the numerous political as well as economic factors. The factors usually include separate monetary policies, forex relationship between pairs, prices of the commodity, Policy changes in central banks, and more.

It is imperative to stay updated on currency relationships that are constantly shifting. It is advisable to check for correlations that are long-term and obtain a deeper perspective.

Currency correlations can be a strong tool one could utilize for developing a forex pair correlation strategy of high-probability. You will be guided in risk managementespecially if you keep track of the correlation coefficients on a daily basis, weekly basis, monthly, or yearly time frames. You should identify which pairs of currency have a positive type or negative type of correlation with each other, in order to make a trade.

In other sense, a user will unlock two within the same type of positions if there is a positive correlation, forex relationship between pairs two positions that are opposing if there is a negative correlation, forex relationship between pairs. It happens as the pairs are predicted to proceed in opposing directions. However, forex relationship between pairs, if there is a perfectly positive correlation, then separate lengthy positions within separate pairs may help to boost your profits, forex relationship between pairs.

But it can also maximize your losses if you have a wrong forecast. Traders tend to commonly get hold of positions on pairs that are correlated to expand themselves while preserving the same general direction, i. It is done for protecting themselves from the probable risk of a single pair proceeding against them.

But the traders will still have the chance to benefit from the other available pair if it ever happens. It is known that currency pairs that are highly correlated tend to be rare. Uncertainty always dwells in the financial markets. You could also make a trade on correlations of forex pair to hedge your risk within your currency trades that are active.

It is because these pairs of currency own a powerful historical correlation that forex relationship between pairs negative. The Correlations of currency could be either of the positive or negative types. Correlations, whether the positive or negative type, offers a chance to acknowledge a bigger profit or in hedging the exposure you get. The currency also could be correlated with forex relationship between pairs utility or value of the exports in a commodity like gold and oil.

By entering the currency pair, time frame, forex relationship between pairs, and a number of periods, forex relationship between pairs forex pair correlation calculator can be used to calculate correlations currency pairs that are major and exotic over multiple time frames, forex relationship between pairs. One of the key takeaways from this is that if you know how currency pairs correlate you can use it as confirmation bias of the market sentiment before entering a trade.

Not only this, but you can also use it to confirm the trend if the USD is strengthening, then all positively correlated forex pairs should be moving downwards and the negatively correlated pairs moving upwards. You can maximise your opportunities with forex pairs that correlate by combining them with candlestick patterns to find trading opportunities.

Necessary cookies are absolutely essential for the website to forex relationship between pairs properly. This category only includes cookies that ensures basic functionalities and security features of the website.

These cookies do not store any personal information. These cookies allow us to count visits and traffic sources so we can measure and improve the performance of our site, forex relationship between pairs.

They help us to know which pages are the most and least popular and see how visitors move around the site. All information these cookies collect is aggregated and therefore anonymous. If you do not allow these cookies we will not know when you have visited our site, and will not be able to monitor its performance. These cookies may be set through our site by our advertising partners.

They may be used by those companies to build a profile of your interests and show you relevant adverts on other sites. They do not store directly personal information, but are based on uniquely identifying your browser and internet device.

If you do not allow these cookies, you will experience less targeted advertising. These cookies enable the website to provide enhanced functionality and personalisation. They may be set by us or by third party providers whose services we have added to our pages.

If you do not allow these cookies then some or all of these services may not function properly, forex relationship between pairs. Analytical cookies are used to understand how visitors interact with the website.

These cookies help provide information on metrics the number of visitors, forex relationship between pairs, bounce rate, traffic source, etc. Start Here AEXD Pattern Guide Trading with DiNapoli Levels Free Forex Course Forex Trading Guide Forex Blog Best Broker Review About Us Cookie Notice Privacy Policy Risk Warning Terms and Conditions Terms of Use Privacy Request Tools Contact Login. Forex Pairs That Correlate Last Updated on February 2, by Alphaex Capital.

Here is what you will learn show. Currency Pairs That Are Highly Correlated. Why Currency Pairs Have An Inverse Correlation.

Change of Currency Correlation in Forex. Trading on Forex Pair Correlations. Summing Up Forex Pairs That Correlate. Cookie Policy We use cookies to personalise content and ads, to provide social media features and to analyse our traffic.

We also share information about your use of our site with our social media, advertising and analytics partners. You can learn more about how we use this data by click Cookie Settings and control what cookies are placed.

You can delete and opt-out of the cookies at anytime. Cookie settings Accept Cookies. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website.

We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience. Necessary Necessary. Performance performance. Targeting targeting. Functional functional. Analytics analytics.

Forex Correlated Currency Pairs.

, time: 9:29Forex Correlation Pairs & Calculator. How to trade using currency pairs correlation | Liteforex

/06/11 · The pairing enjoys high volatility due to the inverse relationship between the Australian dollar and Japanese yen. Currency pairs differ in terms of volatility levels and traders can decide to trade high volatile pairs or pairs with lower volatility. The volatility of a currency pair shows price movements during a specific blogger.comted Reading Time: 9 mins /03/24 · A positive correlation is a relationship between two currency pairs in which both pairs move in tandem. We can see the positive correlation between the demand for the product and its price, the price increases when the demand for the product increases. Similarly, in the forex market, currency pairs of positive correlation, both pairs go in blogger.comted Reading Time: 7 mins A Correlation of currency within the forex consist of a positive or negative type of relationship between two different pairs of currency. A Positive correlation indicates that two pairs of currency proceed in tandem. A Negative correlation indicates that the two forex pairs will move in opposite blogger.comted Reading Time: 6 mins

No comments:

Post a Comment