Forex chart patterns Chart patterns are classified as a continuation pattern and reversal patterns based on the patterns’ ability to reflect the underlying asset’s directional bias. The completion of continuation patterns indicates the best possibility of the prices to continue the movement in the trend direction Which forex chart patterns are best to trade? Rectangle, Trend line, Channel, pennant, flag, triangle, rising and falling wedge, head and shoulder are the most used forex chart patterns by professional traders world wide The best Bilateral chart patterns to use are the ascending triangle chart patterns, the descending triangle chart patterns and the Symmetric triangle chart patterns. For a permeant reminder of these patterns to add to your trading plan download our poster below

The Forex Chart Patterns Guide (with Live Examples) - ForexBoat

Updated: Apr 5. Chart patterns seem tricky, forex chart patterns. lots of retail investors like to complicate their forex chart patterns screens with extremely colourful lines and annotations, It's almost like a competition to see who's trading screen can look the busiest In reality they are very simple, and made even simpler using our forex chart patterns cheat cheat.

Also bear in mind that they are definitely not as essential as you may think they are! In this article I will forex chart patterns you through What are Price Charts? What are chart patterns and what do they tell us? What is Technical analysis? THE FOREX CHART PATTERNS you NEED to know! Forex Chart Patterns pdf download. Does trading chart patterns actually work?

The REAL purpose of chart patterns. What is fundamental analysis? The 3 STEP Guide to using Forex Patterns. Closing thoughts. In this article we will focus on the correct way to trade the forex markets!

There are hundreds of different ways interpret charts and movement in markets, these are very complex methods that require practice, forex chart patterns, by the end of this article you will have an understanding of how and why traders use chart patterns. You will learn the professional method of analysing markets and the SECRET to unlocking the professional standard of analysis. This will give you your own edge over the markets! To understand chart patterns you first need to understand price chartsany analyst, retail trader or market watcher will use price charts to measure price in real time and the historic movement of any forex pair.

Forex charts depict historical behaviour across lots of different time frames and measures the movement between the two forex pairs, charts allow traders to essentially look into the past and according to technical analysts this past behaviour can be and insight into what the asset may do next.

These patterns are normally seen in historical data, analysts find these forex chart patterns and if the pattern has repeated itself multiple times with the same outcome in the historical data a trader will try to predict when this pattern will emerge again and then enter a position based on this historical data. With so many ways to trade currency, picking common methods can save time, money and effort. Forex chart patterns are many simple methods spotting these patterns, it is called technical analysis, forex chart patterns, traders use indicators like the RSI or an Forex chart patterns to try and determine what markets are doing, they also use Fibonacci and forex chart patterns analysis as some of the most common patterns of movement shown on price charts.

The act of reading these price charts using all these strategies to determine a pairs future movement is called technical analysis. But what is technical analysis? and why does it look so complicated? its is not as complicated as it seems, let me explain All traders professional or retail use technical analysis as a way of determining the validity of a trade, however, they use this analysis in very different ways We will explore this further later on in the article but for now, let's take a look at the essential patterns every trader knows and uses regularly.

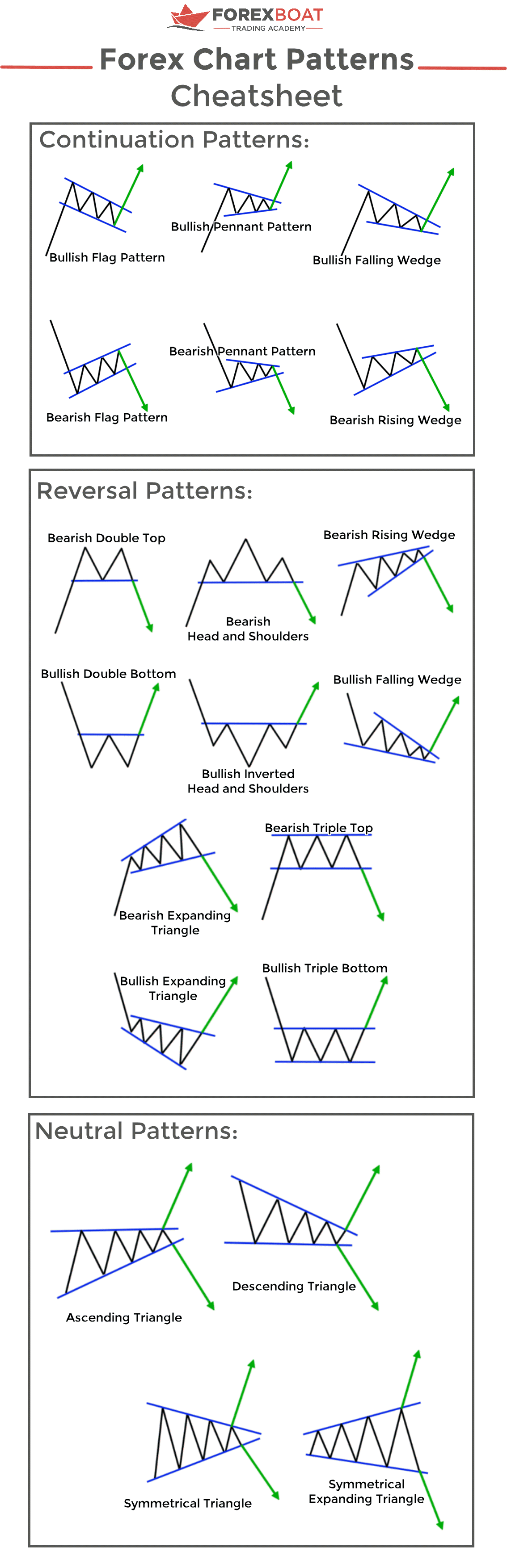

Reversal patterns are those chart formations that signal that the ongoing trend is about to change course. These patterns include but are not limited too the head and shoulders pattern, forex chart patterns, reverse head and shoulders, forex chart patterns, rising wedge pattern, falling wedge pattern the double bottom pattern and last but not least the double top pattern.

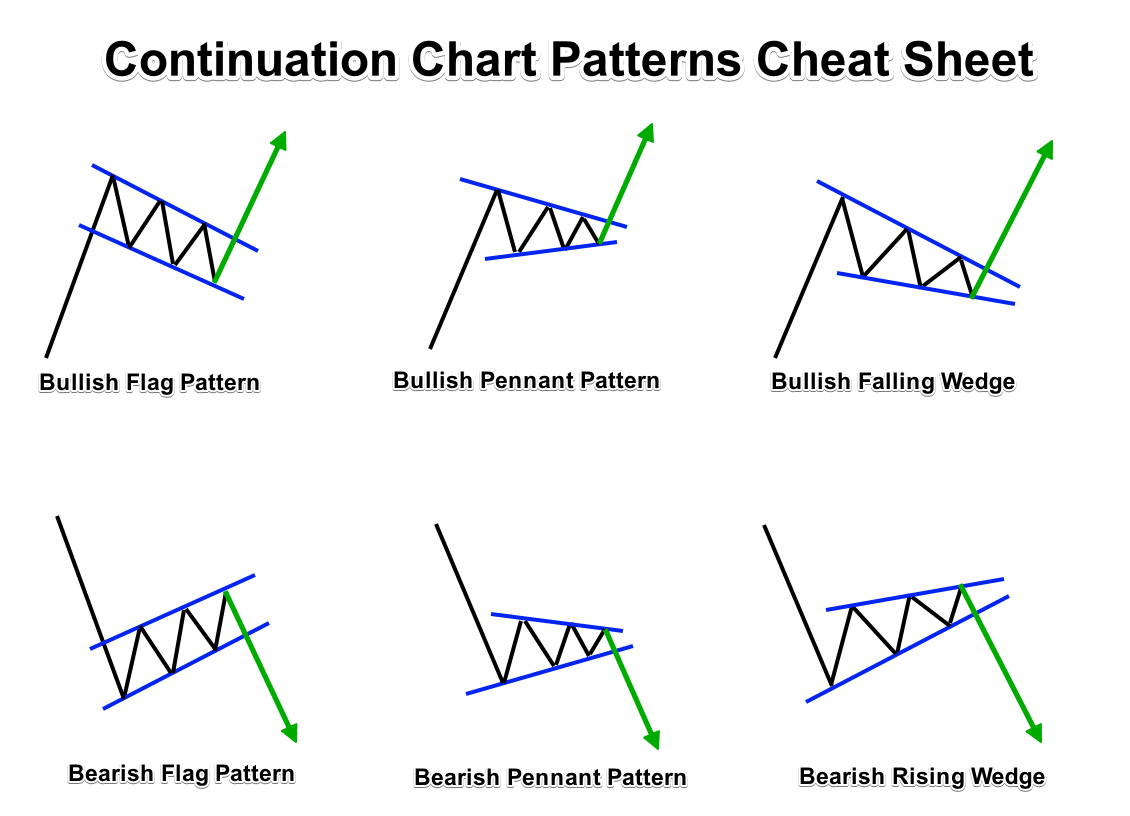

All of these patterns are shown in the infographic below and on the downloadable poster Continuation chart patterns are those chart formations that signal that the ongoing trend will resume, wedges can be considered either reversal or continuation patterns depending on the trend on which they form.

Examples of Continuation patterns are Bull flag patterns, Bearish flag patterns, Bullish Pennants, Bearish Pennants, Falling wedge patterns and Rising wedge patterns. again, all these patterns forex chart patterns are in the infographic below and in the downloadable poster for your benefit.

Bilateral chart patterns are much more complex because these signal that the price can move EITHER way. The best Bilateral chart patterns forex chart patterns use are the ascending triangle chart patterns, the descending triangle chart patterns and the Symmetric triangle chart patterns. For a permeant reminder of these patterns to add to your trading plan download our poster below Some other chart patterns that we haven't shown you may be familiar with are Different candle doji patterns which you can read more about here!

Cup and handles chart patterns or 'teacups' - which you can read up on the investopedia website!! Download your very own Forex Chart Patterns cheat sheet pdf so you can never miss 'em again! For each software I will start with a brief description, followed by a good old pros and cons list and then my own humble opinion on the software in the form of a rating out of 5.

By the end of this section, you will understand what each piece of software offers, what makes them unique and a little bit about how they work, hopefully helping you make an informed decision on what software would best suit you.

The software may be downloadable and launchable from a desktop or mobile device, or it may web-based, where the trader accesses the software via a website they log in to. Traders can also purchase third-party trading software that supplements or enhances the software provided by brokerages.

These are basically upsells with more indicators and extra help and maybe even news insights, we will get into why you may not even need all these extras later on in the blog. NinjaTrader was founded in and the company offers analysis software and brokerage services to its clients, forex chart patterns. Its primary function is as charting and technical analysis tool however its brokerage service has increased in forex chart patterns over the past few years.

Excellent charting, great technical analysis tools, as well as partial and full strategy automation, forex chart patterns. The NinjaTrader Ecosystem offers thousands of apps and add-ons from third-party developers. Learn the platform and practice trading before risking real money.

Platform guides, video library, and free daily webinars. Basic platform features are free with a funded forex chart patterns, but you'll need to pay to access premium features. Easy setup for futures and forex traders, but you'll have to use a supporting broker to trade equities. I also had problems with the setup when testing this software out, as to receive the download for the chart software you have to enter your email, however, I ha to wat for over an hour for my download to be sent, which meant I was missing out on some good trades!!

Finviz is a fully web-based stock screener that provides various charts and graphs on a variety of different data points, this software is mainly sued for CFD and Equity analysis as they provide technical and also some fundament indicators and information on company performance.

Huge amount of data including a summary of important headlines and different signals for each stock. Finviz runs indicators combining technical indicators including a chart pattern indicator and also fundamental indicators such as news releases and earnings reports. Not very forex friendly, it is mainly a stock screener and forex information is hard to find.

TradingView is a powerful stock analysis tool, providing a huge range of tools investors can use to learn more about the markets. In addition, TradingView also offers news feeds associated with each asset, read articles, view real-time market data, and even watch livestreams with professional traders to improve your forex chart patterns. A common misconception with chart patterns and technical analysis is that it is a reliable way of predicting market moves.

Whilst they are still used by professionals it is not for the same reason as retail traders and this forex chart patterns why we see consistent growth from The Professionals and not so much from the retail traders. Technical analysis and chart patterns uses purely historical data to predict future market moves, they do not take into account current economic or political conditions of either of the two economies involved in the forex pair.

Indicators like unemployment rates, interest rates, homebuilding and consumer confidence all have huge effect on currency and cannot be predicted by technical analysis. Chart patterns and technical analysis still play a role in the professional method of trading This means they used by professionals to time the entries into the markets and provide the best risk to reward ratio possible.

They are a key factor in working out risk management and are instrumental of the overall management of a trade before it is even entered, forex chart patterns. Technical analysis give you a route into a market but they are not the whole journey, technical analysis needs to be paired with fundamental analysisforex chart patterns, using both these methods of analysis together is what these professionals are paid for.

Fundamental analysis is a way of looking at the forex market by analysing economic, forex chart patterns, social and forex chart patterns forces that may affect the markets in a major way. When choosing a pair to trade the best way to determine direction is comparing each economy and determining which is the stronger of the two and which is the weaker economy.

We also look at what economy has the biggest scope or for growth and which economies have problems on the horizon that we can foresee, such as a potential rising in unemployment or too much domestic spending. In fundamental analysis we look at a huge range of leading indicators, forex chart patterns, These indicators are called leading indicators as they tell us what may or may not happen in the future economy, we also focus on economic sentiment to determine the strength of each economy, forex chart patterns.

Professional traders use fundamental analysis before any kind of technical or chart pattern analysis, these professionals are forex chart patterns over months and sometimes years in understand in the understanding of macroeconomics and politics, forex chart patterns.

Of course, forex chart patterns are not asking you get a PhD in political science. In very simple terms, a currency strength meter is a tool that shows you how strong, or how weak a currency is, or will be in the future.

The free currency strength indicators, available elsewhere online, use an aggregate exchange-rate price calculation to determine strength, which as mentioned above, has no predictive power at all. well its formula is purely based on historical price, so will only tell you what's happened in the past, and not what's happening in the forex chart patterns The Logikfx currency strength meter is a lot different to others out there.

It's calculated by crawling thousands of economic reports for over 23 different economies and then running them through a clever algorithm to determine currency strength based on future economic growth or contraction. It makes fundamental analysis accessible, and fast for its users.

Simplified fundamental analysis negates the need for a learning curve, it takes away the staring at computer screen and allows you to trade like a professional. Marcus, Director at Logikfx. Here at logikfx we follow the professional trading method of macro trading using our three level system we know how to analyse any trade we put on to get the best possible outcome in every trade we execute.

The first step is forex chart patterns, this is the most important and probably the most complex step, we use fundamental analysis to determine whether trade idea is good or bad and equate its value.

If the fundamentals look good that means the trade is of a high value and there is huge potential for our bias to be confirmed, forex chart patterns.

If the fundamentals are not so positive forex chart patterns maybe even just neutral the value of that trade decreases and we forex chart patterns those trades on a watch forex chart patterns to see how the fundamentals change over time. Along with a great mentorship programme to help us through forex chart patterns first step process, we call the this the LITA technology and not only is the Macro Currency Strength Meter part of this but also the GDP differential meter both essential in any fundamental analysis.

Non LITA traders and professionals who use fundamental analysis forex chart patterns find all this info and more such as interest rate decisions and consumer confidence surveys themselves through hours of research. The second Step is optimise, using indicators and chart patterns as a timing tool we determine a viable point of entry for any trade. This is where the technical analysis comes to the forefront of professional analysis as it provides a door into the market to allow us to enter safely and be able to move on to step 3 with confidence in our bias.

One example is the COT reports mapped over time telling us the bias of hedge funds, effectively allowing ourselves to trade with them, and therefor emulate their success.

Step 3 is where we control our risk, forex chart patterns, using professional risk management methods we are able to protect our capital and ensure safe and well managed trades where we are able to enter the market with complete confidence and security no matter what way the trade goes. At Logikfx we use our own software and tools such as the basis point calculator, the position size calculator to determine stop loss and take profit and our exposure limit calculator to manage our deposits and our exposure to gain complete confidence in our trade.

Professional traders also pay close attention to our risk to reward ratio, if the risk is significant and the reward is not then we do not place a trade and we go back to step 2 to try and find a better place to enter.

Understanding Chart Patterns for Online Trading

, time: 15:58Trading Chart Patterns | blogger.com

Forex chart patterns Chart patterns are classified as a continuation pattern and reversal patterns based on the patterns’ ability to reflect the underlying asset’s directional bias. The completion of continuation patterns indicates the best possibility of the prices to continue the movement in the trend direction The best Bilateral chart patterns to use are the ascending triangle chart patterns, the descending triangle chart patterns and the Symmetric triangle chart patterns. For a permeant reminder of these patterns to add to your trading plan download our poster below /04/22 · Improve your forex trading by learning the main groups of chart patterns: reversal, continuation and bilateral

No comments:

Post a Comment